The world is progressing at a rapid pace with new data being entered every now and then. Managing this data and deducing information from it has become even more difficult if one solely relies on human effort. Not only will it require more time and money but the chances of error will also increase. To fulfill the needs of the company in an urgency and to make sure that the process of bookkeeping is being carried out efficiently, it is advisable to go with a CPA trial balance software. Here are the advantages which one can enjoy:

The world is progressing at a rapid pace with new data being entered every now and then. Managing this data and deducing information from it has become even more difficult if one solely relies on human effort. Not only will it require more time and money but the chances of error will also increase. To fulfill the needs of the company in an urgency and to make sure that the process of bookkeeping is being carried out efficiently, it is advisable to go with a CPA trial balance software. Here are the advantages which one can enjoy:

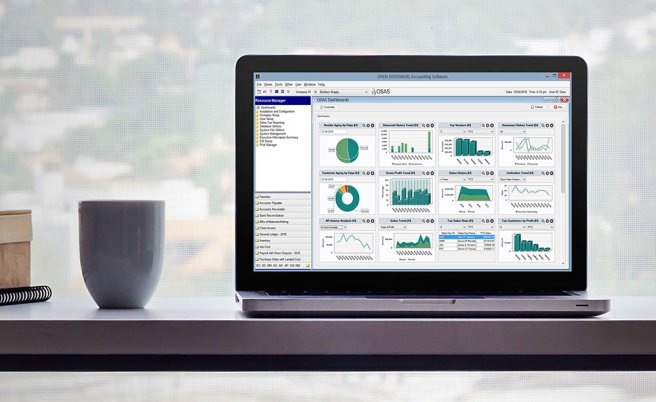

All-In-One Platform

To optimize the productivity and to speed up the work processes, it becomes essential to use a CPA software for the trial balance. Such a software will not only allow the person to work on trial balance but will also be a solution to keep a check on the accounts payable, accounts receivable, general ledger, payroll tax compliance, financial statement reporting, client bookkeeping, and bank reconciliation.

Flexibility across Different Industries

Working on a specific software doesn’t mean that you now can have a limitation of serving only a handful of industries. Any CPA software is always flexible and always has the ability to broaden its spectrum across a number of fields. It can also accommodate different entity types and report periods while maintaining standardized processes and efficiency across the entire structure.

Integration with Other Software

There are times when you need to import or export heaps of information from one software to another in order to perform a specific task. This is possible through a CPA trial balance software which can easily gather information from multiple sources so that it can check the totals of debits and credits along with authenticating different journal entries. Even if you are looking for advanced features, you can work in contribution with other software.

Security Features

There is no denying that a huge amount of sensitive financial data is being dealt with currently so the highest standards of security and protection are required. A software will be able to abide by these rules and will ensure that there is no breach in the security of the data which is so integral to the company. All the actions which might affect the client data in one way or the other can also be controlled by the accountant and some even allow tracking the details like time and date when a particular action took place.

Multiple Staff Working Concurrently

A CPA trial balance software will also allow a number of accountants to access the information and make the necessary changes at the same time. This further assists the efficiency and empowers them to divide the workload in a preferred way. The staff can also specialize on specific tasks and make sure that they are working together to achieve a uniform goal.

Given the above-mentioned benefits of this software, it is undeniable that using it in a workspace has become essential.